As a rule of thumb a person who makes 50000 a year might be able to afford a house worth anywhere from 180000 to nearly 300000. If you make 70K a year you can likely afford a house payment between 1500 and 2000 a month depending on your personal finances.

How Much House Can I Get With 100k Income Youtube

Another rule of thumb is the 30 rule.

. The value of the home or mortgage you can afford in Texas is dependent on several factors such as down. This means that if you make 100000 a year you should be able to afford 2500 per month in rent. Your budget and financial situation will determine how much you can afford on a 100k salary but in most cases youll likely qualify for a home worth between 350000 to 500000.

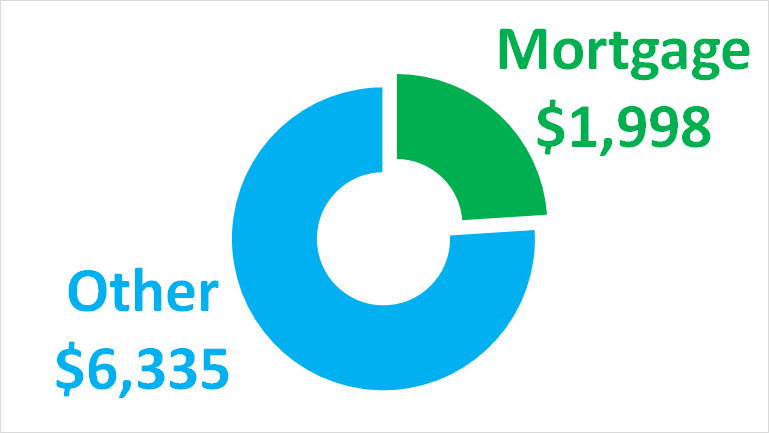

With a salary of 100000 per year how much house can I afford. You should buy a property that wont take anything more than 28 percent of your gross monthly income. Gross monthly income 8333 Principal and interest payment 1250 Property taxes 250.

To calculate u2018how much house can I affordu2019 a good rule of thumb is using the 2836 rule which states that you shouldnu2019t spend more than 28 of your gross monthly income on home. How much can I borrow if I make 100k. What is the monthly payment of the mortgage loan.

The most common rule for deciding if you can afford a home is the 28 percent one though many are out there. How much house can I afford if I make 100K per year. BUT and this is a big but this number assumes you have very little debt and 112000 in the bank.

If you earn 100000 per year you should be able to pay 2500 in rent per month if you earn 100000 per year. The amount you can borrow for a mortgage depends on many variables and income is just one of them. For example if you earned 100000 a year it would be no more than 2333 a month.

The most common rule for deciding if you can afford a home is the 28 percent one though many are out there. Experts suggest you might need an annual income between 100000 to 225000 depending on your financial profile in order to afford a 1 million home. How Much Mortgage Can I Afford With A 100k Salary Foundation Mortgage For many years this was the main rule of thumb to follow.

Assuming a 4 mortgage rate and a 30000 down payment that. Even for people on. Your debt-to-income ratio DTI credit score down payment and interest rate all factor into what you can afford.

If youre wondering with 100k salary how much house can I afford the 25 rule gives you a mortgage of 250000. With a 10 deposit contribution worth just over 68000 the maximum affordable property price would be 682000. How much do you have to make a year to afford a 1000000 house.

A 500 car payment can reduce your buying power by. With a mortgage at 275 pa. The 30 percent rule is yet another useful rule of thumb.

A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your affordability. Financial Home Home Equity Calculator Mortgage Payment Rent versus Buy Calculator Simple Mortgage Payment Calculator Annual Income Monthly Debt Cash in hand for down payment Property tax rate Home Insurance rate Interest Rate Length of Loan years. It states that a household should spend no more than 28 of its gross monthly income on the front-end debt and no more than 36 of its gross monthly income on the back-end debt.

If you have a 20 down payment on a 100000 household salary you can probably comfortably afford a 560000 condo. Calculate the highest value of the property you can buy by taking your gross income and multiplying it by 25 or 3. 1866 650 x 100000 290000 their maximum mortgage.

House Max Budget. 100000 annual gross income at 30 2500 per month. The amount you receive will be 30000 if you take 30 of 100000.

If you earn 100000 per year you should be able to pay 2500 in rent per month if you earn 100000 per year. According to the 2836 rule prospective homeowners with a 120000 income can afford a 1 million home on a 30-year fixed mortgage. How much house can I afford if I make 100K per year.

What salary do you need to buy a 400k house. The amount you receive will be 30000 if you take 30 of 100000. Find out how much house you can afford with our home affordability.

Make sure to consider property taxes home insurance and your other debt payments. The above table gives an estimate of how much house individuals with a 100k annual income in Texas can afford. The 2836 Rule is a commonly accepted guideline used in the US.

How much home can I afford if I make 110000. Experts suggest you might need an annual income between 100000 to 225000 depending on your financial profile in order to afford a 1 million home. And Canada to determine each households risk for conventional loans.

This equates to a loan amount of 614000. Most home loans require a down payment of at least 3. You can easily calculate yours using the Home Affordability Calculator Zillow.

How much home can I afford if I make 110000. For example if you earned 100000 a year it would be no more than 2333 a month. How Much House Can I Afford In Texas Making 100k A Year Home By Four Those policies can be as much or more than the standard homeowners insurance.

How much house you can afford on 100k also depends on how much debt you currently have including auto loans student loans credit cards and other loans. That means two people who each make 100000 per year but have different credit scores debt. Use this calculator to calculate how expensive of a home you can afford if you have 110k in annual income.

The 30 percent rule is yet another useful rule of thumb. This calculator allows you to calculate the amount you can afford to pay for a mortgage. For instance someone with low credit might only be eligible for a 300000 mortgage while someone with excellent credit might qualify for a 500000 mortgage.

For a 250000 home a down payment of 3 is 7500 and a down payment of 20 is 50000. You want to keep your debt payments as low as possible. If you have a 20 down payment on a 100000 household salary you can probably comfortably afford a 560000 condo.

If you take 30 of 100000 you will get 30000. Thats because annual salary isnt the only variable that. Using a 45 percent interest rate and a 30-year term this translates into 1267 monthly which equals 456017 over 30 years.

How Much Mortgage Can I Afford With A 100k Salary Foundation Mortgage

Mortgage For 100k Top Sellers 57 Off Www Ingeniovirtual Com

How Much House Can I Afford Bhhs Fox Roach

I Make 100 000 A Year How Much House Can I Afford Bundle

Mortgage For 100k Top Sellers 57 Off Www Ingeniovirtual Com

How Much Of A Mortgage Can I Afford Making 150 000 A Year

What Kind Of House Can I Afford Making 100k Store 55 Off Www Ingeniovirtual Com

How Much House Can I Afford On 100k On Sale 54 Off Www Ingeniovirtual Com

0 comments

Post a Comment